What is RPGT?

RPGT is Real Property Gain Tax. That’s the full form of the acronym. But what is it about? Let me answer that question for you. Real Property Gain Tax, also know as RPGT is a tax seller have to pay for selling their property in Malaysia when the seller gain/profit from the sales transaction.

what about selling at a loss?

What about selling at a loss? When selling at a loss, the seller will not have to pay the RPGT tax. This is because nobody should be taxed for making a loss.

discounts and deductions?

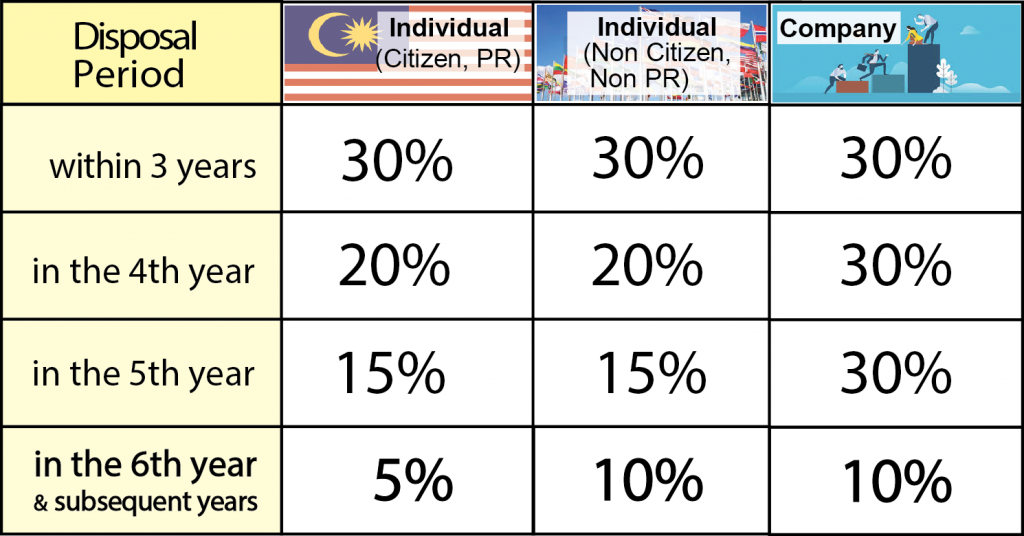

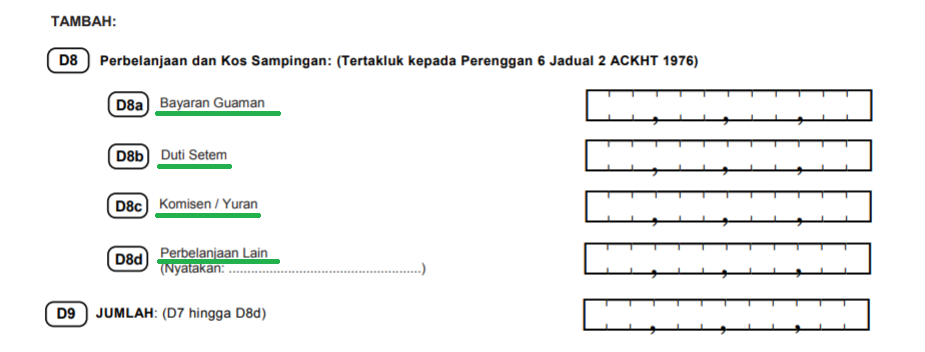

Are there any discounts and deductions? The law, more specifically, the RPGT Act from 1976 allows certain RPGT tax deduction based on allowable miscellaneous charges (allowable cost) such as legal fees, stamp duty, agent’s professional fees, repairs/renovations fees, valuation fees and advertising fees. Hence, do keep all the necessary receipts!

How does the RPGT work?

RPGT is only imposed on the net chargeable gain from your sale. It is charged on the profit you made, minus any waivers or deductible miscellaneous costs.

Firstly, let’s find out your CHARGEABLE GAIN/GROSS GAIN amount.

Chargeable Gain = Property Sold Price – Purchased Price

Secondly, let’s move on to find the NET CHARGEABLE GAIN/NET GAIN:

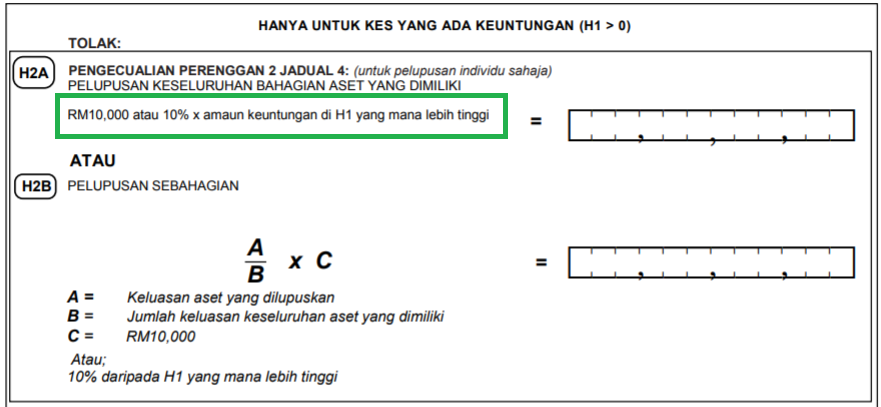

Net Chargeable Gain = Chargeable Gain – Exemption Waiver [RM10,000 or 10% of Chargeable Gain; whichever is higher] – Allowable Costs

Finally, calculate the total amount of RPGT you will need to pay.

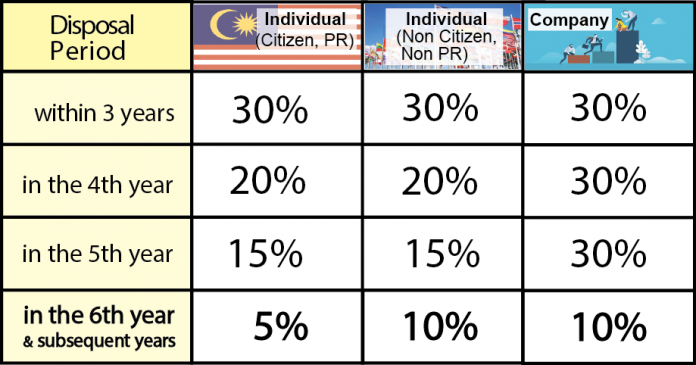

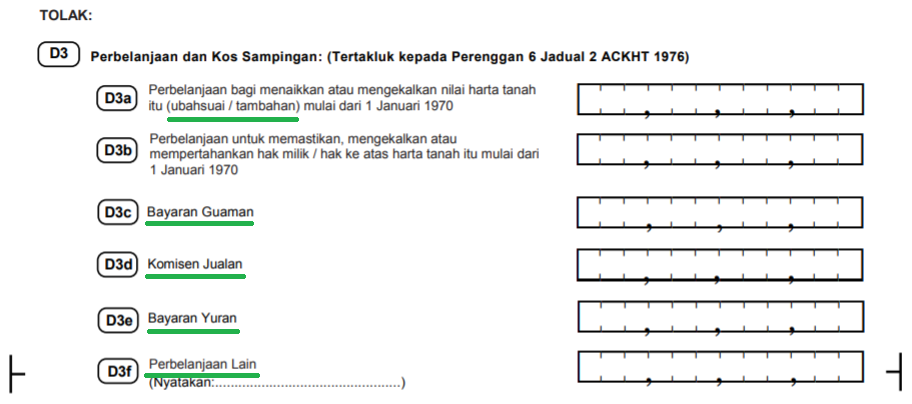

RPGT to pay = RPGT Tax Rate (disposal of property based on holding period) x Net Chargeable Gain

Example:

Mr Tan is Malaysia Citizen. He bought a property 10 years ago for RM500,000. Now at 2019, he sold off the property for RM800,000. Before and during the selling process, he was spending about RM50,000 for maintaining his property, lawyer fees for sales and other miscellaneous costs which allow for exemption.

Chargeable Gain: RM800,000 – RM500,000 = RM300,000 (Gross Gain)

Net Chargeable Gain: RM300,000 – RM30,000 (10% of chargeable gain waiver) – RM50,000 (allowable costs) = RM220,000

RPGT Rate (based on holding period) x Net Chargeable Gain

Since Mr Tan has owned the property for more than six years, his RPGT rate will be 5%. Hence;

Total RPGT= RM220,000 x 5%, which is RM11,000

what about ownership transfers?

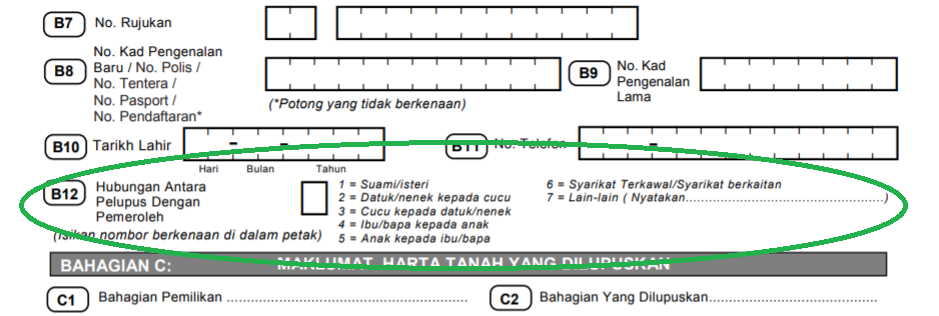

What about the property’s ownership transfer to my family members? RPGT tax will not be applicated when transferring owned property to certain family members. For instance, a transfer between husband and wife, a parent to their child or from a grandparent to a descendant and many more. Note that not all transfers between family members and kins will be exempted, this includes siblings, cousins, buddies and so on.

Are there penalties for paying late?

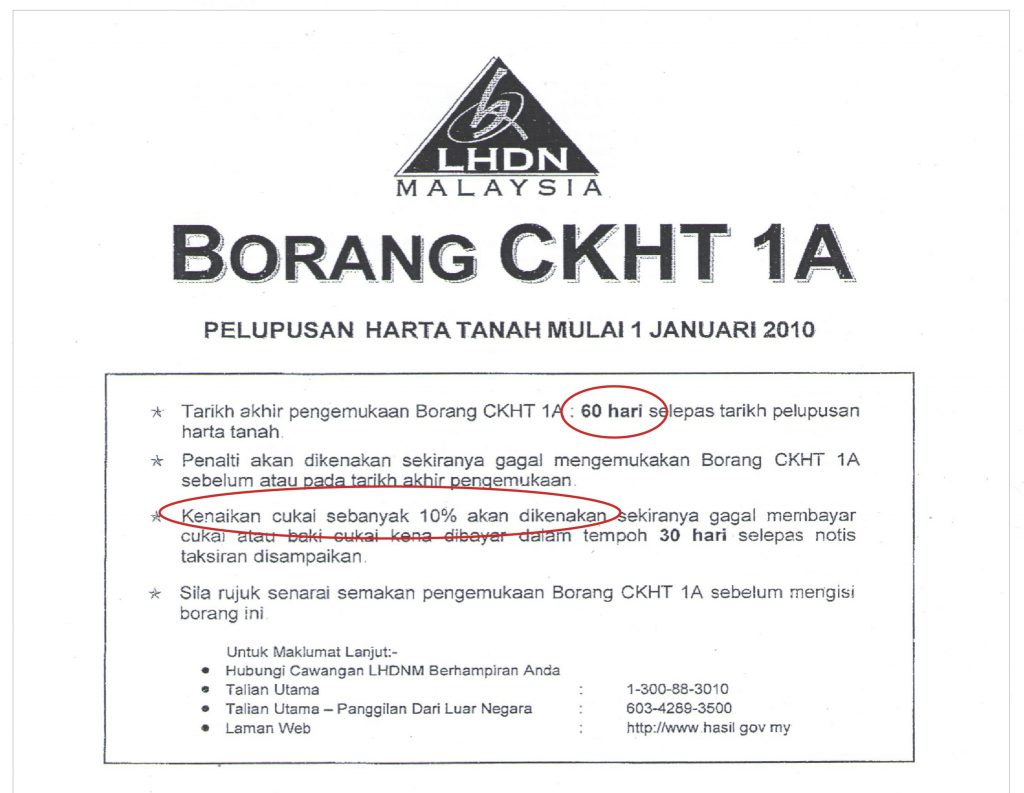

“Nah! Let’s pay it later!”. Procrastination is common among Malaysians, but be wary not to drag too long, as after 60 days, the owner will be penalized with a 10% of the total RPGT amount as penalty. This penalty is very much a hassle, therefore, let’s be punctual on the RPGT tax payment.

Does the property type matter?

“How about a factory?” Does the property type matter? Speaking generally, no. The RPGT tax has to be paid regardless of the building type. For example, a factory, an apartment, a villa or a storage facility will all have to be entitled to this RGBT tax whenever that’s a gain. But, if you own a property that is RM200,000 or below, like medium or low-cost property, you are exempted.

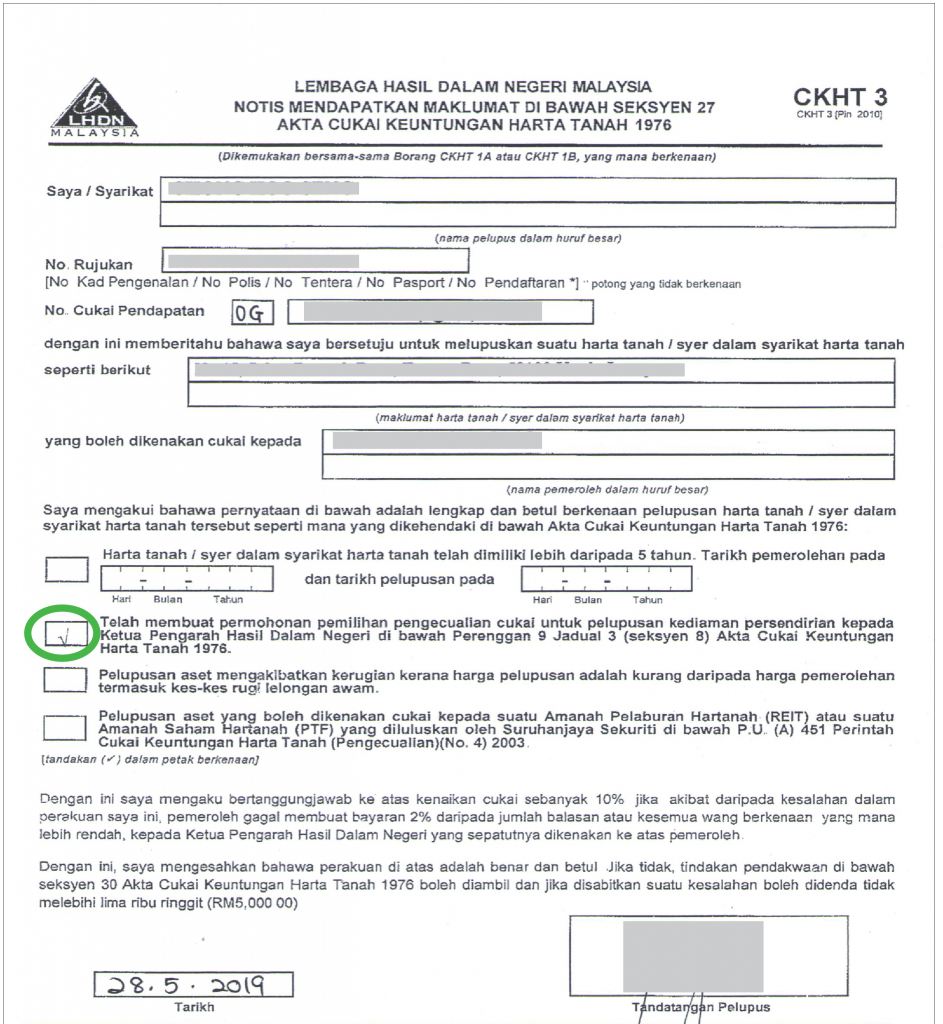

But wait! Remember that one-time exemption? It makes an exception here. The one-time exemption can only be used once in a lifetime, in a single transaction and can only be used on certified residential title properties. This means that sellers can’t use the exemption on all commercial properties, like factories, shop lots and empty lands.

RPGT forms?

You can download all RPGT related forms from IRB’s website. They are:

- CKHT 1A – Disposal of Real Property (for the seller)

- CKHT 2A – Acquisition of Real Property (for the buyer)

- CKHT 3 – Exemptions ( for the seller)

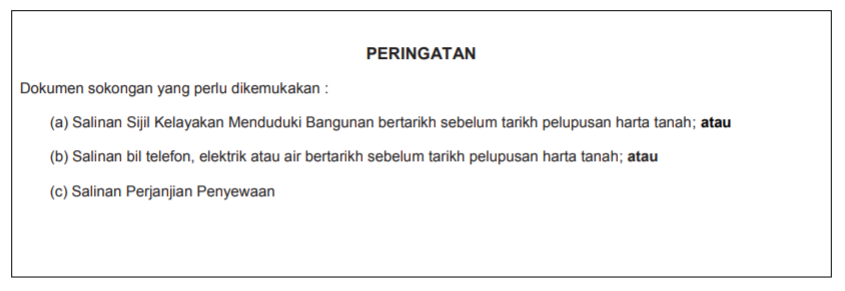

Do I have to complete all the RPGT forms/documents on my own? Yes, you can. Or generally, your lawyer can handle and do the calculations for you. But you are advised to prepare the relevant documents or receipts in order to justify your deduction.

Still confused? Let’s take a quick revision again on RPGT EXEMPTION for a better understanding before we end this article:

- Selling at a loss

- The one-time exemption, once in a lifetime from the disposal of residential property

- Disposal of property between family member

- Selling a medium or low-cost property that is RM200,000 or below

- Waiver of RM10,000 or 10% of chargeable gain; whichever is higher, this applies to every transaction

We hope you are now having a clearer picture of RPGT. Please share our article if you like and find it informative. Thank you! 😊