Wondering what is the buying process for sub-sales property in Malaysia?

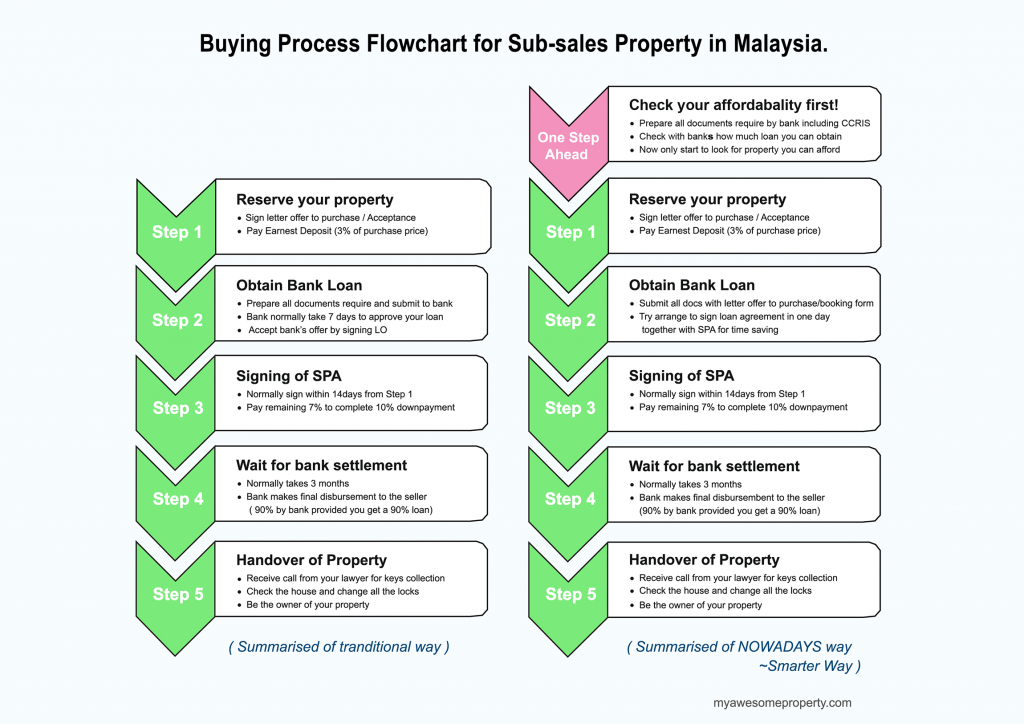

For a quick look, you can refer to our summarised buying process flowchart above.

Step 1

Reserve Your Property

Once you have found the right property and get the best offer price from your Real Estate Negotiator, you will now be asked to pay a 3% booking fees to the Real Estate Agency’s stakeholder account and sign the letter offer to purchase in order to reserve your desired property. The remaining 7% will have to be paid upon signing S&P.

Step 2

Obtain Bank Loan

To obtain bank loan, you will have to prepare all the required documents and submit it together with the letter offer to the bank. What documents are required for bank loan application? You can refer to our related post.

Bank will assess your credit profile to determine whether your loan application to be approved or rejected. Normally we will advise the buyer to apply at least 2 banks in order to select the lowest interest rate and the product that suits you best.

Once the bank approves your loan, they will issue an Offer Letter for you to sign in acceptance.

Step 3

signing of spa

You have to appoint a lawyer to execute the SPA (Sales and Purchase Agreement) and Loan Agreement. Try to engage the lawyer who can process the two agreements above to sign at once in order to save time and cost. After the agreement been signed, the lawyer will move on to stamp the agreement and perform the transfer registration at the Land Office Registry.

For most normal and straight-forward cases, this will take about 3 months to complete.

Step 4

Wait for bank settlement

Wait for the bank settlement. Banks will make final 90% disbursement to the seller provider you get a 90% loan.

Step 5

handover of property

Once the lawyer gets the notification from the bank, they will call you for keys collection and handover the property to you.

Congratulations! Now you are the official owner of your property 😊

PS: Don’t forget to change all the locks and knobs after you check your property.